Simplywise

Calculating Social Security Benefits After Divorce

Understanding the Impact of Divorce

When couples divorce, the division of assets and income can have a significant impact on their financial future. One important consideration is the calculation of Social Security benefits, which can provide a vital source of income during retirement. In this article, we will explore how divorce affects Social Security benefits and guide you through the steps involved in calculating your entitlement.

Benefits for Divorced Spouses

*

Spousal Benefits:

If your marriage lasted at least 10 years and you are unmarried at the time of claiming benefits, you may be eligible for spousal benefits based on your ex-spouse's earnings record. The amount of spousal benefits you receive is typically equal to half of your ex-spouse's primary insurance amount (PIA), which is the amount they would receive at full retirement age. *

Survivor Benefits:

If your marriage lasted at least nine months and your ex-spouse has passed away, you may be eligible for survivor benefits. The amount of survivor benefits you receive is typically equal to the full PIA of your ex-spouse.

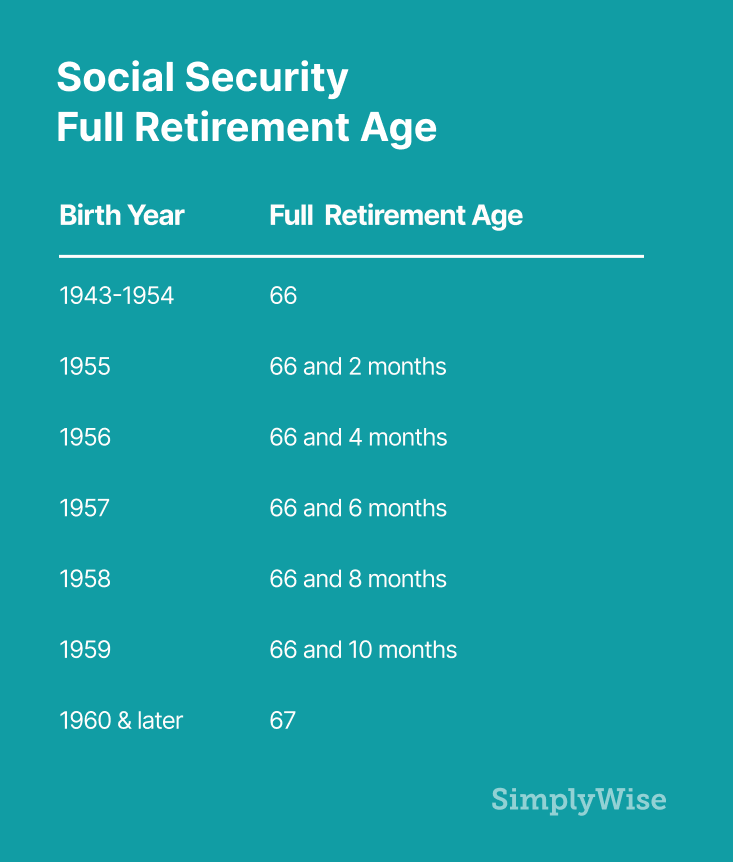

Calculating Your Benefits

**1. Determine Your Ex-Spouse's PIA:** Obtain your ex-spouse's Social Security statement or contact the Social Security Administration (SSA) to get their PIA. **2. Calculate Your Spousal Benefit:** If eligible, multiply your ex-spouse's PIA by 50% to determine the amount of spousal benefits you can receive. **3. Calculate Your Survivor Benefit:** If eligible, the amount of survivor benefits you can receive is equal to your ex-spouse's full PIA. **4. Consider Age and Work History:** Your age at the time you claim benefits and your own work history will also affect the amount of benefits you receive. Early retirements and low earnings can reduce your benefits, while delaying retirement and having a higher income can increase them. **5. Contact the SSA:** To file for Social Security benefits, contact the SSA to schedule an appointment or apply online. They will assist you with determining your eligibility and calculating the amount of benefits you are entitled to receive.

Additional Considerations

*

Remarriage:

If you remarry, your entitlement to spousal or survivor benefits may be impacted. The SSA will provide guidance on how remarriage affects your benefits. *

Taxes:

Social Security benefits are subject to taxation. The amount of taxes you pay will depend on your income and filing status. *

Divorce Planning:

It is crucial to consult with an experienced divorce attorney to understand the legal and financial implications of divorce on your Social Security benefits. A divorce planning partner can assist you in making informed decisions that protect your future financial well-being.

The Medicare Family

Comments